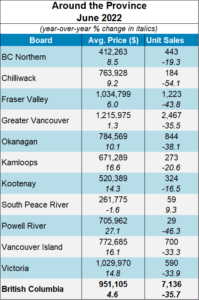

Vancouver, BC – July 12, 2022. The British Columbia Real Estate Association (BCREA) reports that a total of 7,136 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in June 2022, a decrease of 35.7 per cent from June 2021. The average MLS® residential price in BC was $951,105, a 4.6 per cent increase from $909,657 recorded in June 2021. Total sales dollar volume was $6.8 billion, a 32.8 per cent decline from the same time last year.

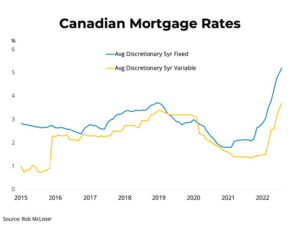

“While a still growing economy and robust population growth point to strong demand, it is increasingly difficult to satisfy that demand at current interest rates,” said BCREA Chief Economist. “As a result, sales activity across the province, but especially in more expensive markets, continues to slow.”

For the second straight month, year-over-year provincial active listings rose, with listing in June 16.4 per cent higher than this time last year. While active listings remain below what is typical for a balanced market, some markets and housing types have tipped into balanced or even buyers’ market territory as sharply higher mortgage rates push potential buyers to the sidelines.

Year-to-date, BC residential sales dollar volume was down 17 per cent to $53.5 billion compared with the same period in 2021. Residential unit sales were down 27.6 per cent to 51,202 units, while the average MLS® residential price was up 14 per cent to $1.05 million.